Total Valuations by Region

| Region | Institutional Valuation | Buffett Valuation |

|---|

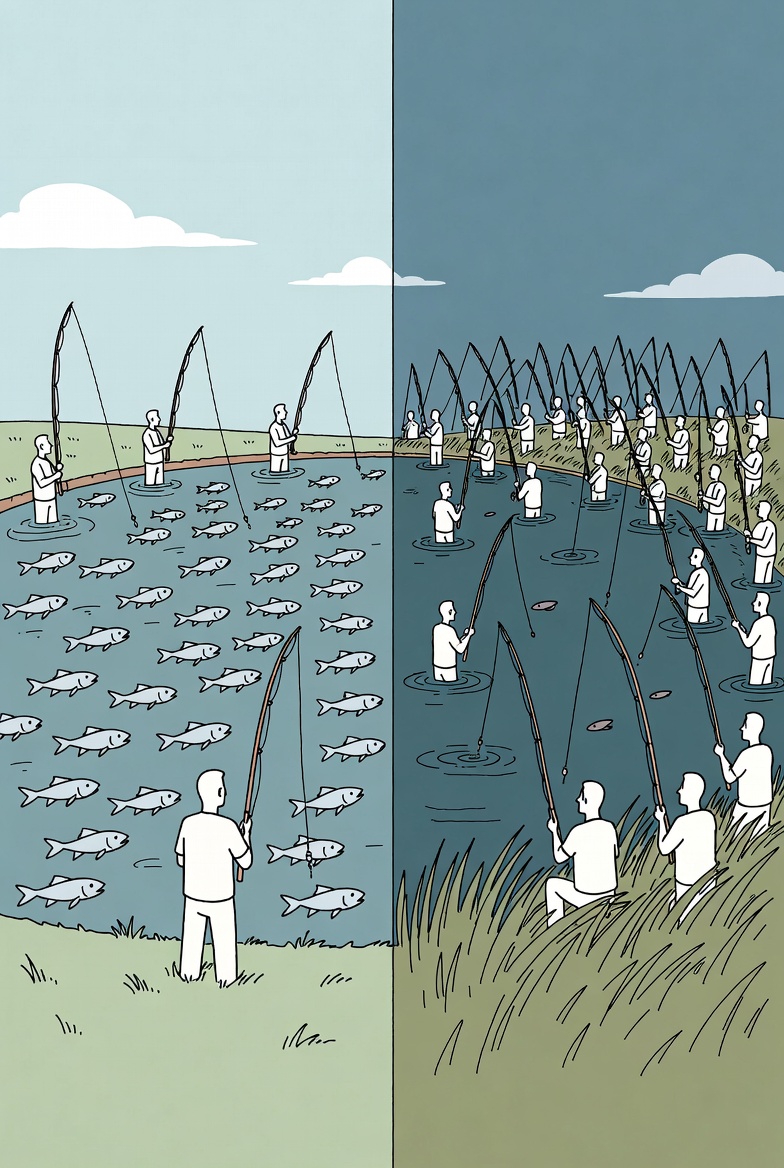

The first step of investing is deciding where to invest! We do this by looking for where there are the most "cheap" stocks that no one is buying. Examples of this would be 2002-2003 USA, 2007-2010 USA, 2021-2025 China, 2025 Europe, etc.. The rotations will be cyclical and never-ending.

I have re-created every index in the world, calculated the fair value of each stock within the index, and added them up market-cap weighted.

As of today (January 2026), China is where the easy money will be made. Philosophically, we want to fish where there are many fish and few fishermen. Even a poor strategy will have good results in such an environment. A great strategy will have life-changing results.

投资的第一步是决定投资哪里!我们通过寻找最多“便宜”股票但没人买的地方来做到这一点。例如:2002-2003 美国,2007-2010 美国,2021-2025 中国,2025 欧洲 等。这些轮换将是周期性的且永无止境。

我重新创建了世界上每一个指数,计算了指数中每只股票的公允价值,并按市值加权相加。

截至今天(2026年1月),中国将是轻松赚钱的地方。从哲学上讲,我们想在鱼多而渔夫少的地方钓鱼。即使是一个差劲的策略在这样的环境中也会取得好结果。一个伟大的策略将带来改变人生的结果。